Act Now!

While North Carolina offers several incentives to commercial solar owners, none will have a larger impact that the USDA's REAP Grant. The 50% rebate on your solar energy system is one of the best incentives offered in the history of the solar industry, so take advantage of the USDA's REAP Grant while it is still available. Fill out our interest form to get started!

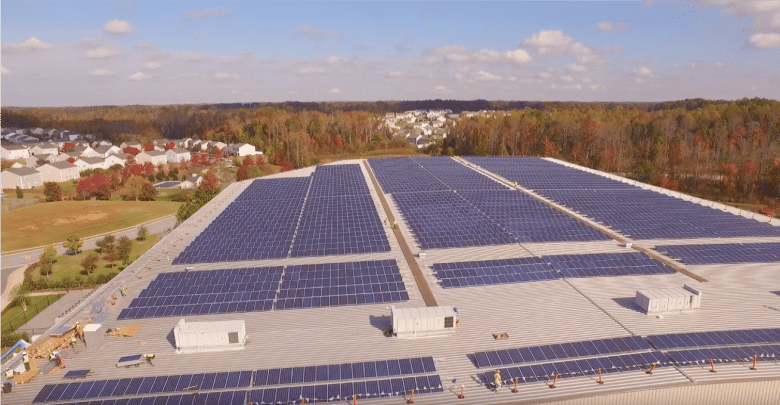

Solar Incentives in North Carolina

While Duke Energy provides service to multiple states, its Solar Rebate Program is only available in North Carolina. Commercial customers get 30 cents per watt for a rebate of up to $30,000.

North Carolina offers an 80% property tax exemption for commercial installations, meaning only 20% of the value of your solar system will count towards your taxable property value.

A tax deduction is available to owners of qualified commercial buildings in North Carolina. For property placed in service in 2023 and after, the deduction equals $0.50 per square foot of any building with 25% energy savings. This increases by $0.02 per square foot for each percentage point beyond 25%, up to a maximum of $1.00 per square foot for a building with 50% energy savings. Projects that meet labor requirements detailed in the Inflation Reduction Act can qualify for a huger deduction of between $2.50 and $5.00 following the same rule as above with a $0.10 increase per square foot instead of $0.02.

The REAP Grant is available in:

|

|

|

|

|

Ready to add solar to your business?

Let us connect you with the right installation team.